.png)

STAY VIGILANT. STAY PROTECTED.

FRAUD ALERTS

Fraudsters are constantly evolving their tactics. At Profinium, your financial safety is our priority. Use this page to stay informed about current scams and learn how to protect yourself and your accounts.

Current Scams to Watch

-

MN Department of Revenue

-

We are monitoring reported text messages that claim to be from the Minnesota Department of Revenue asking you to update banking information. If you get one of these messages, do not reply or click any link in it. We will never send unsolicited texts asking for personal data.

-

-

Imposter Scams

-

Scammers may pose as Profinium team members, government agencies, or law enforcement. They often pressure you to act quickly or send money. Always verify by calling us directly at 1-800-254-6191.

-

-

Text and Email Phishing

-

You may receive a message that appears to be from your bank or a known company. Never click unfamiliar links or share personal information.

-

-

Phone Call Spoofing

-

Fraudsters can spoof caller IDs to make it look like a legitimate call. If anything feels off, hang up and contact Profinium directly.

-

-

Zelle® Fraud

-

Be cautious of requests to send money using Zelle®. Profinium will never ask you to move funds between your accounts using Zelle® or any other payment app.

-

What to Do if You Suspect Fraud

- Do not respond to suspicious texts, calls, or emails

- Do not share account numbers, login credentials, or verification codes

- Contact Profinium immediately if you think your account has been compromised

- Report scams to the Federal Trade Commission at reportfraud.ftc.gov

How Profinium Helps Protect You

We use industry-leading security measures, account monitoring, and fraud detection tools to keep your money safe. You’ll also receive real-time alerts and support from our local team.

Tips to Protect Yourself

- Set up account alerts in your Profinium online banking dashboard

- Use strong, unique passwords for each financial account

- Monitor your statements regularly for unauthorized activity

- Don’t share your debit card PIN or online banking credentials

- Update your contact information so we can reach you quickly in case of suspicious activity

Important Fraud Alert: Impersonation Scams Targeting Bank Customers

We want to make you aware of a recent increase in fraud attempts affecting bank customers across the region.

Fraudsters are calling, texting, and emailing customers while pretending to be from their bank. In some cases, they may reference real employee names or appear to use legitimate-looking email addresses to gain trust.

Please remember:

We will never contact you to ask for your online banking username, password, one-time passcodes, or other login credentials.

What We’re Seeing

Scammers may:

-

Call or text you pretending to be from the bank, sometimes from out-of-state phone numbers

-

Ask for online banking usernames and passwords, company IDs, or tax ID numbers

-

Claim they “work with” the bank and reference real bank employees by name

-

Send emails that look legitimate, including messages sent from addresses similar to @billsupport.com while impersonating a bank

-

Use stolen login information to attempt large ACH transfers, customer-to-customer transfers, or Zelle payments

-

Target business accounts and attempt to move funds quickly through ATMs, shared branches, or other withdrawal methods

How to Protect Yourself

-

Never share your online banking credentials with anyone

-

Do not click on links or respond to unexpected texts or emails claiming to be from your bank

-

If a message feels urgent or suspicious, pause and verify before taking action

-

Contact us directly using the phone number on our website or the back of your debit card

If you believe you may have been contacted by a scammer or shared information in error, please notify us immediately so we can help protect your account.

Your security is extremely important to us, and we appreciate your vigilance. Thank you for helping keep your accounts safe.

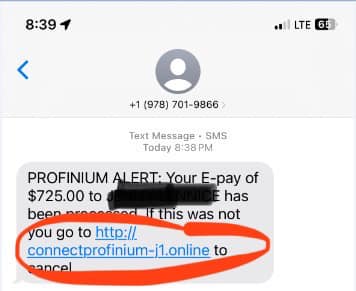

Phishing Attack Attempt with Text Messages

Updated December 30, 2024

It has come to our attention that we have fraudsters using Profinium’s name to get people to click on the link within a text.

A phishing attack is like a scammer pretending to be someone you trust. They will send fake emails, texts, or messages that look official, hoping you will click on a link or share personal information, like passwords or bank details.

Common Signs of Phishing:

- The message creates urgency: “Act now to avoid account suspension!”

- It asks for sensitive info: “Confirm your password here.” In the screenshot above people are asked to click on the link and then add personal account information.

- The sender’s email/web address looks off, like support@banksecure123.biz.

Remember:

- Do not click suspicious links or download attachments.

- Verify the sender by contacting the company directly.

- Legitimate companies will not ask for sensitive information via email or text.

Four Password Tips to Help Protect Yourself

-

Use Unique Passwords: Never use the same password across multiple accounts. If one is breached, all accounts with the same password could be compromised.

-

Enable Multifactor Authentication: Adding an extra layer of security to your logins is quick and effective.

-

Use Pass Phrases: Longer is stronger! A simple line from a favorite song or quote is easier to remember and tougher to crack.

-

Try a Password Manager: If you’re juggling too many passwords, let a password manager do the heavy lifting. It keeps your passwords secure and easily accessible.

Quick strategy for protecting information from data breaches

Create accounts with the credit reporting bureaus and put freezes on your credit files.

This is also a good idea in general as it protects you from any other data breach that may not have been reported. The only drawback to doing this is needing to unlock it when applying for credit. So, make sure you keep those passwords somewhere secure.

Credit Freeze

There are instructions on the USA.gov website with links to each credit reporting bureau. There are also ways to request a credit freeze by phone but creating accounts also allows you to check your credit history for any incorrect information.

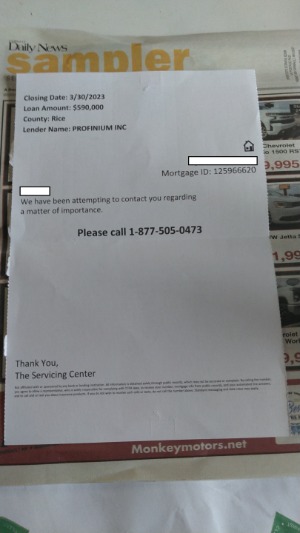

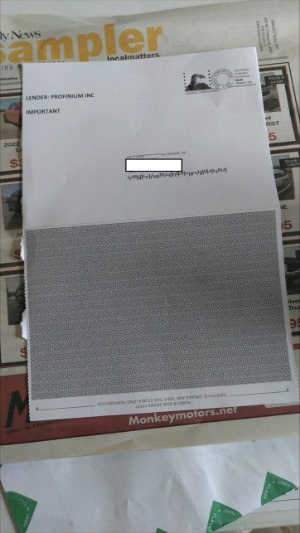

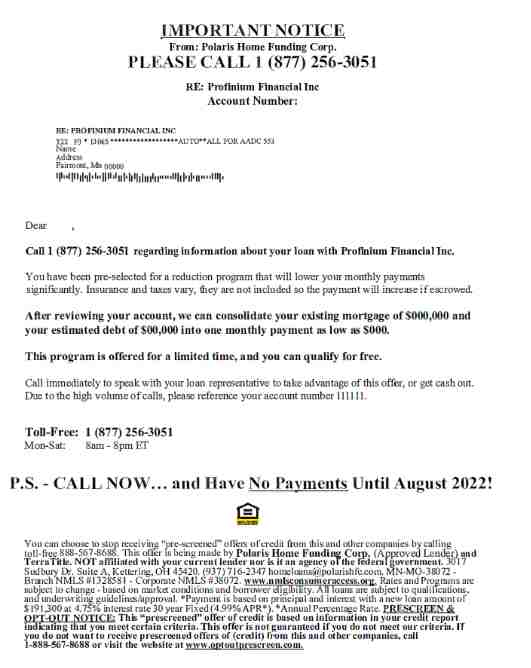

This letter appears to be from Profinium and has a telephone number listed for the customer to call. This letter did not come from Profinium. The letter also gives the impression of urgency, as most scams do.

We take our client security and privacy very seriously, so it is important to know that the information in the letter did not come from Profinium. Real estate loan information is public through county records. All real estate mortgages are recorded at the county level, and this is one way that someone could obtain the information. Please be cautious as we are unaware of the letter's origin.

.jpg)

TIP #1: Respond promptly to your debit card alert texts & phone calls.

If our 24/7 debit card monitoring system notices a transaction that may seem out of the ordinary you will receive a text or call to confirm or decline the transaction. If you do not respond, out of extra precautionary measures, the system will inactivate your debit card until we can confirm the purchase is legitimate.

TIP #2: Use the chip insert or tap whenever possible.

When using the chip or tap your card number is scrambled. If the company has a breach or becomes compromised your actual card number will not be available to the villains since it has been scrambled.

TIP #3: Use your PIN to Verify your purchases.

Your PIN is a way for the computer system to recognize it’s you making the purchase. Using your PIN is like using a password. As long as you don’t share your pin with anyone, it confirms your purchase is you by your PIN (Personal Identification Number).

Scammer target thousands of people in the United States. They take multiple approaches to try and trick you:

- Cold calls

- Robo calls

- Text messages

- Emails

- Social media/online sites

- Fake propaganda mailed to you

Let's review how and why they scam you:

Step 1: They will try to alarm you – Scammers want you to feel a sense of urgency. They tell you that something terrible is about to happen to get you to send a payment. They use intimidation and fear to get you to send money immediately before you can have a chance to check out their claims. They urge you to send money to:

- Collect a prize

- Avoid government action against you

- Help a loved one in distress

- They may threaten you with dire consequences like arrest or legal action.

Step 2: Rob you – scammers want to take your money and/or your identity.

- You will be asked to send cash, checks or money orders via USPS, Fed Ex, USP or other overnight/express delivery services.

- You will be instructed to purchase gift cards and provide scammers with the numbers on the back of the cards.

- They will ask for your bank, debit, or credit card information. They may even ask you to send your debit or credit card to them.

Another red flag to remember: Scammers will request that you not share your conversation with anyone.

Types of Scams:

- Ransomware or Tech Support Scams – Scammers use malware to lock files and hold them for ransom or ask individual to call number on screen for help with their computer.

- Pet Scams - Internet connection through Facebook or other websites. Purchase price has to be paid up front as they have a number of buyers interested. Fees emerge that weren’t originally discussed like shipping or veterinary.

- Investment Scam – Infomercial or an ad online saying you can learn how to make lots of money. The company says their system is “proven”.

- Grandparent scam – Someone calls claiming to be their grandchild or other loved one and they need help with a medical crisis or legal trouble.

- Romance Scam – love interest tricks someone into falling for them when they just want their money. Use a few different ways to start the scam, usually online. Scammers may spend time getting to know someone and developing trust before asking for access to finances or a loan. Ask you to send money so that they can travel to see you or they desperately need money for an emergency.

- Money Mule Scams – A money mule is someone who receives and moves money that came from victims of fraud. Money mules may be recruited through online job or social media posts that promise easy money for little effort. (Profinium and customers have been victims of this type of scam in 2023)

- Work-from-home-job – You are asked to receive mail or packages and ship them to someone else. Criminals seek your participation to smuggle illegally purchased goods out or the country. The purchases are made with stolen debit, credit and gifts cards.

- IRS – You owe money and you need to pay it or you will be arrested, sued or they will cease your property.

- The electric company – your power will be turned off.

- Unsolicited calls - trying to get your personal data. Scammers represent themselves as the bank with a question about your account or federal agency notifying you of an issue. They are wanting to verify your account information.

- Lottery or Publishers Clearing House Scam – You won something that you never entered. To claim your winnings, you must pay taxes and various fees by sending payment via cash, money order, wire transfer or credit/debit card.

What to Know & Tips to Reduce Being Scammed:

- Legitimate entities and government agencies will not call you to request money

- The IRS will contact you by mail

- Scammers use apps and other technology to alter caller ID. The phone numbers can appear to be from government agencies or a local call. Do not assume that your caller ID is accurate.

- Scammers often want untraceable payment methods.

- All investments have risks. No one can guarantee a specific return on an investment.

- Don’t buy a pet without seeing the pet in person.

- Do not ACCEPT or TRANSFER money to anyone unknown to you.

- Loneliness is very, very powerful. Social isolation makes lonely people vulnerable to fraudsters. The elderly may have conversations with scammers just to talk to someone on the phone.

- Do not accept packages at your address from people or companies unknown to you. If you receive a package from someone you do not know, refuse the package.

- Legitimate businesses, banks and federal agencies will not ask for personal and financial information over the phone. Never provide account information or your social security number over the phone.

- If you didn’t enter contest.………How did you win? Never pay up front for a promised prize.

- Nothing is free! If you receive money and then are asked to send some back, it is a scam.

- Screen unknown calls.

- A random check in the mail that you weren’t expecting, should be scrutinized.

- If it sounds too good to be true……..it probably is. Why is someone trying so hard to give you a great deal?

Tis the season for online shopping!

If you feel like you found a deal that is too good to be true, that is because it actually might be. Here is how the scam works.

- You see a big discount on something that appears to be from a legit retail website and buy it.

- Unfortunately, the website is operated by fraudsters who then use OTHER people's stolen credit card info to purchase the same item from a legit website and then send it to you.

- You receive your item- sweet! However, now the fraudsters have your card or bank information and will use it in the future for more fraudulent activity.

So what can you do?

- Keep an eye on your transactions. Get in the habit of checking your transactions daily while your online purchases are fresh in your mind. Once you get in the habit, the review can go very quickly.

- Make sure your bank has the capabilities to help you quickly handle fraudulent activity.

- At Profinium, our clients have the ability to turn their debit cards off the second they suspect fraud - no matter the time-of-day 24/7. Visit our debit card page to learn more about our debit card protection.

The IRS is reminding everyone to watch out for IRS impersonation scams. The IRS will not send text messages or email to contact taxpayers about personal or financial information. The IRS also does not leave pre-recorded, urgent or threatening telephone messages for taxpayers. Below is a link with a lot of good information about IRS related scams.

The IRS is also receiving reports of emails urging people to "Claim your tax refund online." and text messages that the person's tax return was "banded" by the IRS. The scams are filled with spelling errors and awkward phrasing. Our days get busy, and we quickly respond trying to stay on top of things. Remember to try and pause when these sorts of messages pop up.

Our team has received a number of phone calls from customers receiving text messages claiming their debit card is blocked. The contact number and link in the text are not from Profinium and this appears to be a phishing scam.

Please delete the text immediately without responding to it.

Phishing is a type of hacking where the attacker sends a fraudulent message with the intent to trick the recipient into sharing personal information or giving the attacker the ability to install malicious software on your device. As a reminder, we will never ask you for your personal information over text or email.

If you have any questions, please do not hesitate to call us (800) 254-6197.

Mortgage Letter Not Sent by Profinium

It has come to our attention that a letter is being sent to community members regarding their mortgage.

At first glance, it appears that it may have come from Profinium. This letter DID NOT come from Profinium. We have received a copy of the letter and have included a sample below for you to review.

Also, it is very important to note that the mortgage information listed in the letter did NOT come from Profinium. Mortgage information is available publicly to any who knows where to find it. We are unable to confirm if this is 100% a scam so please use caution if you inquire about this letter.

If you have questions please do not hesitate to call your banking team.

Check Depositing Scam

We’ve seen an influx in customers depositing checks that they’ve received in the mail that they were not expecting or aware they would be receiving. The most recent one was a customer asked to buy gift cards and then send the serial numbers to the check sender.

What the scammer is trying to do is get you to cash the check and then have you send them the cash. When checks are presented to a bank, each check goes through a clearing house to verify the check is good/valid. By the time the check goes through this process and comes back as fraudulent the scammer is long gone with the cash. You, as the person that cashed the check, are now on the hook for the cash.

Here are some questions to ask yourself:

- Was I expecting the check?

- Example, you receive an insurance claim check but you do not have a claim going with your insurance company.

- Do I know who sent this check?

- Am I being asked to send money or gift cards back to the sender?

- Does it seem too good to be true?

If you are not expecting a check or you are suspicious about a check, do not cash the check until you talk to a representative at your bank.

Fraudulent E-mail/Phishing Schemes

We have received a few calls from customers regarding suspicious emails they've received. Please be aware that there are phishing schemes involving emails that appear to be from IRS.gov, NACHA.org. as well as FDIC.gov. Here is some information that may be beneficial to you, our valued customers:

From IRS.gov website:

The IRS never sends out unsolicited emails, and under no circumstances, requests credit card information and pin numbers through email. Persons receiving emails that claim to be from the IRS should not attempt to visit any site contained within the email and should report suspicious emails to TIGTA or IRS.

Please notify the IRS of any phishing attempts by forwarding the suspicious e-mail to phishing@irs.gov. Materials forwarded to this mailbox will be examined and acted on by our information security staff.

Elder Fraud

We have seen an uptick in elder fraud lately. According to the Federal Bureau of Investigation and the Internet Crime Complaint Center (IC3), elder fraud is defined as financial fraud scheme which targets or disproportionately affects seniors.

Common Elder Fraud Schemes Include:

- Romance Scam

- Tech Support Scam

- Grandparent Scam

- Government Impersonation Scam

- Sweepstakes/Charity/Lottery Scam

- Home Repair Scam

- TV/Radio Scam

- Gamily/Caregiver Scam

- Investment Scam

"What do I do if someone I know may have been a victim of elder fraud?"

File a complaint with the FBI’s Internet Crime Complaint Center.

www.ic3.gov

An additional resource created by the U.S. Department of Justice (DOJ), Office for Victims of Crime, is the National Elder Fraud Hotline and can be reached at (833) 372–8311.

An additional resource created by the U.S. Department of Justice (DOJ), Office for Victims of Crime, is the National Elder Fraud Hotline and can be reached at (833) 372–8311.